Tokenomics

We are working on updating this section after the IOTA EVM release and will publish an updated version of the Tokenomics in the coming weeks.

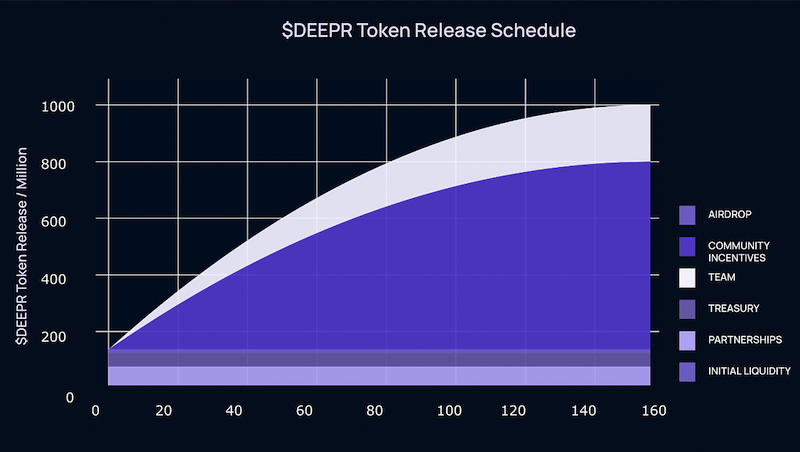

Deepr Finance has a simple tokenomics model. The model will have a Total Supply of 1,000,000,000 tokens (named $DEEPR). $DEEPR will be minted and distributed according to the following scheme.

DEEPR Allocation

DEEPR Emission

We’ve made it really simple for you to earn $DEEPR:

- Liquidity Mining: Earn $DEEPR rewards by simply supplying collateral and borrowing from the protocol (for example, imagine if you received shares in a bank for depositing funds and borrowing).

- Airdrop: The airdrops will take place over time through various campaigns and activities, which will be announced through our social media channels.

- DEX Initial Liquidity Offer: Prior to launch we will announce an opportunity to provide initial liquidity for our token ($DEEPR) via our ShimmerSea partner.

We have decided to focus on launching via a fair launch model which has been a successful model for lending platforms.

We’ve allocated a huge percentage of the $DEEPR tokens to the community, because we want to ensure that as many of our tokens as possible are in the hands of our users. This strategy ultimately creates long term success and value creation for all stakeholders.

DEEPR Token Value & Utility

Governance

The governance of Deepr Finance will initially lie in the hands of the Deepr Finance team. Strategic decisions such as collateralization ratio, interest rates, emission rates etc. will only be made after consulting with advisors and our community. But as we believe in decentralized decision making, that involves all stakeholders we intend to gradually pass on full governance to the community and stakeholders. For this governance process, the $DEEPR token plays an essential role as an utility token with voting functionality. According to the governance rules, token holders will be able to submit ideas, vote on them, and delegate votes for proposals in a decentralized manner.

Passive income

In the future users will be able stake their $DEEPR tokens to receive a portion of the fees generated by the protocol. Therefore $DEEPR token holders will have the ability to earn passive income from the lending markets with the intention of locking large percentages of the token during this process.

As we add more features to the Deepr Finance platform, the $DEEPR token will see an increase in utility and value accrual.

Emission Model

The Emission Distribution will be a spread of tokens to the users of the platform per Block for 156 weeks (3 years), in return for their participation in the platform.

An amount of tokens per block will be delivered to users, depending on the Deepr Finance market in which they are participating (supply and/or borrow), and the percentage of participation of the user in the market.

The model is designed to deliver fewer and fewer tokens each week (a linear function with a negative slope that will be explained later), so that once week 157 arrives, there are no more tokens left to distribute to users.

It is key to mention that Deepr Finance uses an important part of the original distribution logic of Compound, which has a constant distribution of the tokens, instead of our decreasing distribution.

Linear Equation Contract

The emission distribution model used is a linear equation with a negative slope that reaches a distribution of 0 tokens in week/epoch 157. This means that in the first week we will have the Maximum Rate (RateMAX) and from there it will decrease linearly in a proportional rate to the slope, until reaching 0 in week 157.

Before presenting the equation, the RateMAX and the Slope will be calculated so that the equation is easier to see. Recall that the amount of tokens to distribute is 864M $DEEPR.

With these values we can already obtain the linear function:

To implement this model, a new smart contract called LinearRateModel has been created, which will contain all the logic of the linear equation. The Comptroller contract, responsible for distributing tokens to users, can easily access this contract to obtain the current rate that complies with the equation whenever it needs to be consulted.

As block creation is done on demand, epochs will be measured in fixed numbers of weeks, in units of seconds (with one week being one epoch). Using block intervals would have led to complications, as a spamming agent could increase the number of blocks, leading to more calculations in the emission of $DEEPR.